Tax Saving Mutual Funds Investment

Tax Saving Mutual Funds Investment Specification

- Regulatory Body

- SEBI

- Investment Mode

- Lumpsum / SIP

- Investor Type

- Resident Individuals & HUFs

- Withdrawal Option

- After completion of lock-in period only

- Tax Section

- Section 80C of Income Tax Act

- Redemption Process

- Online/Offline

About Tax Saving Mutual Funds Investment

Tax Saving Mutual Funds Investment offers tax benefits to individuals. These funds primarily invest in equity and equity-related instruments, providing the potential for high returns over the long term. Investing in tax-saving mutual funds helps individuals to save on taxes while simultaneously providing an opportunity to grow their wealth. Tax Saving Mutual Funds Investments are professionally managed, accessible, and offer a variety of investment options to suit different risk appetites and investment goals.

Minimum Lock-In Period and Withdrawal

ELSS investments come with a compulsory lock-in period of three years, ensuring disciplined savings. Withdrawals are permitted only after this lock-in ends, empowering investors with flexible redemption options via online or offline channels.

Tax Benefits Under Section 80C

Investing in ELSS allows resident individuals and HUFs to claim tax deductions of up to 1.5 lakh under Section 80C of the Income Tax Act. This benefit enhances overall financial planning by optimizing tax liabilities and fostering systematic wealth accumulation.

Flexible Investment Modes: Lumpsum and SIP

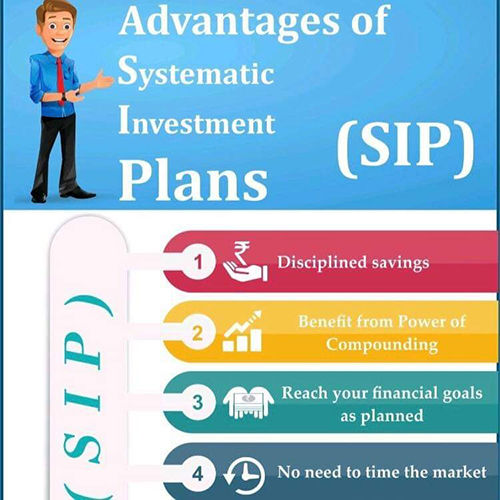

ELSS schemes support both lumpsum and systematic investment plans (SIP). This flexibility enables investors to tailor their contributions according to their financial strategies, promoting disciplined and accessible investment habits.

FAQ's of Tax Saving Mutual Funds Investment:

Q: How can I invest in Tax Saving Mutual Funds?

A: You can invest in ELSS tax saving mutual funds either as a lumpsum or through a systematic investment plan (SIP), using online platforms of service providers or by visiting their branches offline.Q: What is the lock-in period for Tax Saving Mutual Funds?

A: The mandatory lock-in period for ELSS investments is three years. You can redeem your units only after completing this period.Q: When and how can I withdraw my mutual fund units?

A: Withdrawal of units is permitted only after the three-year lock-in period. Redemption can be done easily online through your service provider's portal or offline by submitting a form at their branch.Q: What tax benefits do these funds provide under Section 80C?

A: Investments in ELSS mutual funds allow resident individuals and Hindu Undivided Families (HUFs) to claim tax deductions up to 1.5 lakh per financial year under Section 80C of the Income Tax Act.Q: Which entities regulate Tax Saving Mutual Funds in India?

A: Tax saving mutual funds are regulated by the Securities and Exchange Board of India (SEBI), ensuring investor protection and fund transparency.Q: Who can invest in these mutual funds?

A: Resident individuals and Hindu Undivided Families (HUFs) are eligible to invest in ELSS mutual funds and avail tax benefits under Section 80C.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry