Systematic Withdrawal Plan SWP

Price 500 INR/ Set

MOQ : 1 Set

Systematic Withdrawal Plan SWP Specification

- End Date

- Till units last or as opted by investor

- Taxation

- Depends on type of mutual fund and holding period

- Product Name

- Systematic Withdrawal Plan (SWP)

- Documentation

- SWP registration form

- Charges

- Subject to exit load as per scheme, if applicable

- Lock-in Period

- Applicable for tax saving mutual funds only

- Withdrawal Amount

- Fixed or variable

- Redemption Process

- Automated, as per the chosen schedule

- Partial Withdrawal

- Allowed as per plan rules

- Minimum Investment Amount

- Varies as per scheme

- Start Date

- Chosen by investor

- Type

- Mutual Fund Withdrawal Option

- Modification/Cancellation

- Allowed anytime as per AMC rules

- Payout Mode

- Direct transfer to registered bank account

- Purpose

- Regular cash flow or passive income

- Flexibility

- High investor decides amount and frequency

- Eligibility

- Available to all investors of eligible mutual fund schemes

- Withdrawal Frequency

- Monthly/Quarterly/Semi-Annually/Annually

Systematic Withdrawal Plan SWP Trade Information

- Minimum Order Quantity

- 1 Set

- FOB Port

- INDIA

- Payment Terms

- Telegraphic Transfer (T/T)

- Supply Ability

- 100000 Sets Per Day

- Delivery Time

- 5 Minutes

- Sample Policy

- Free samples are available

- Main Export Market(s)

- Asia

- Main Domestic Market

- All India

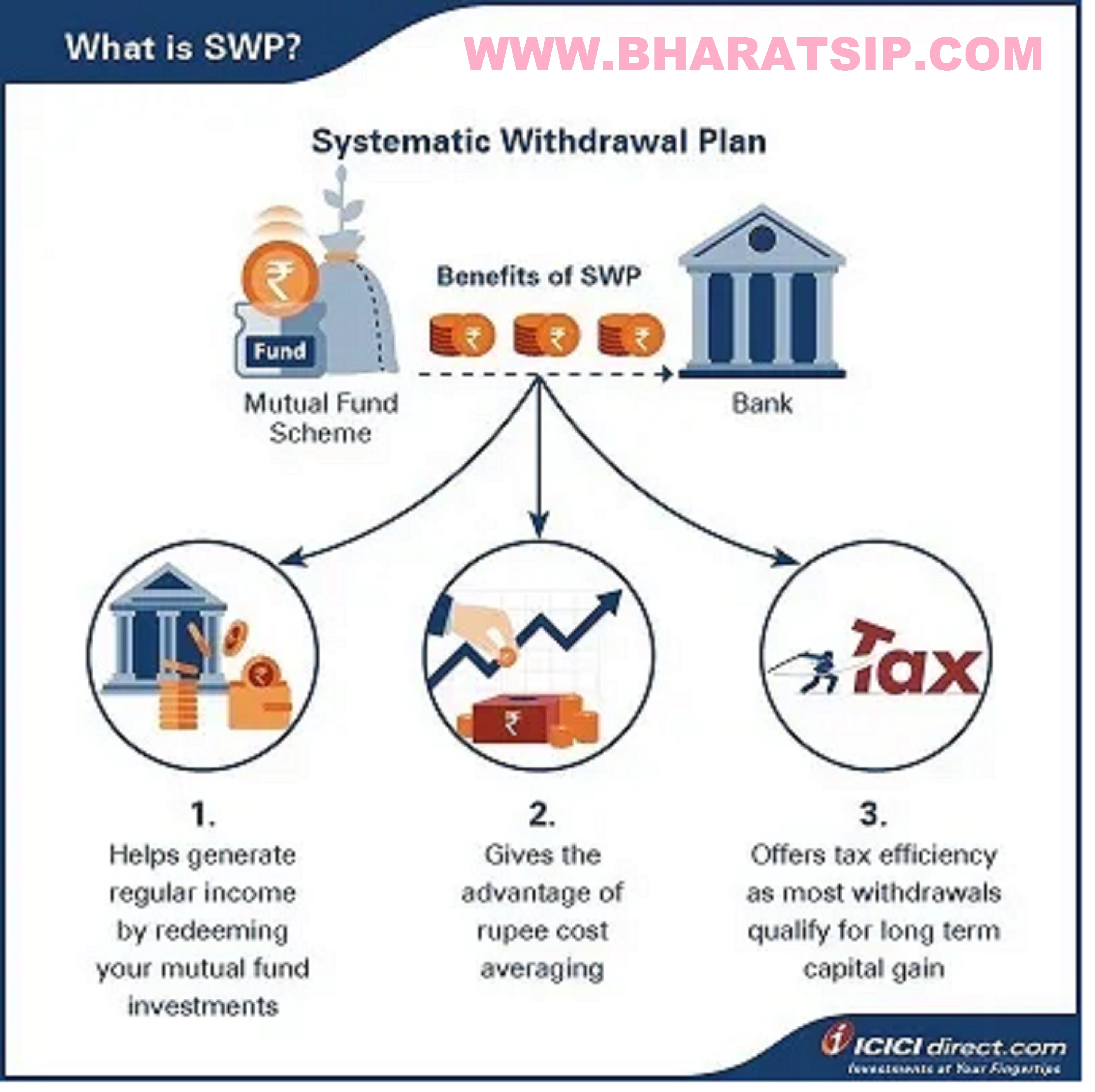

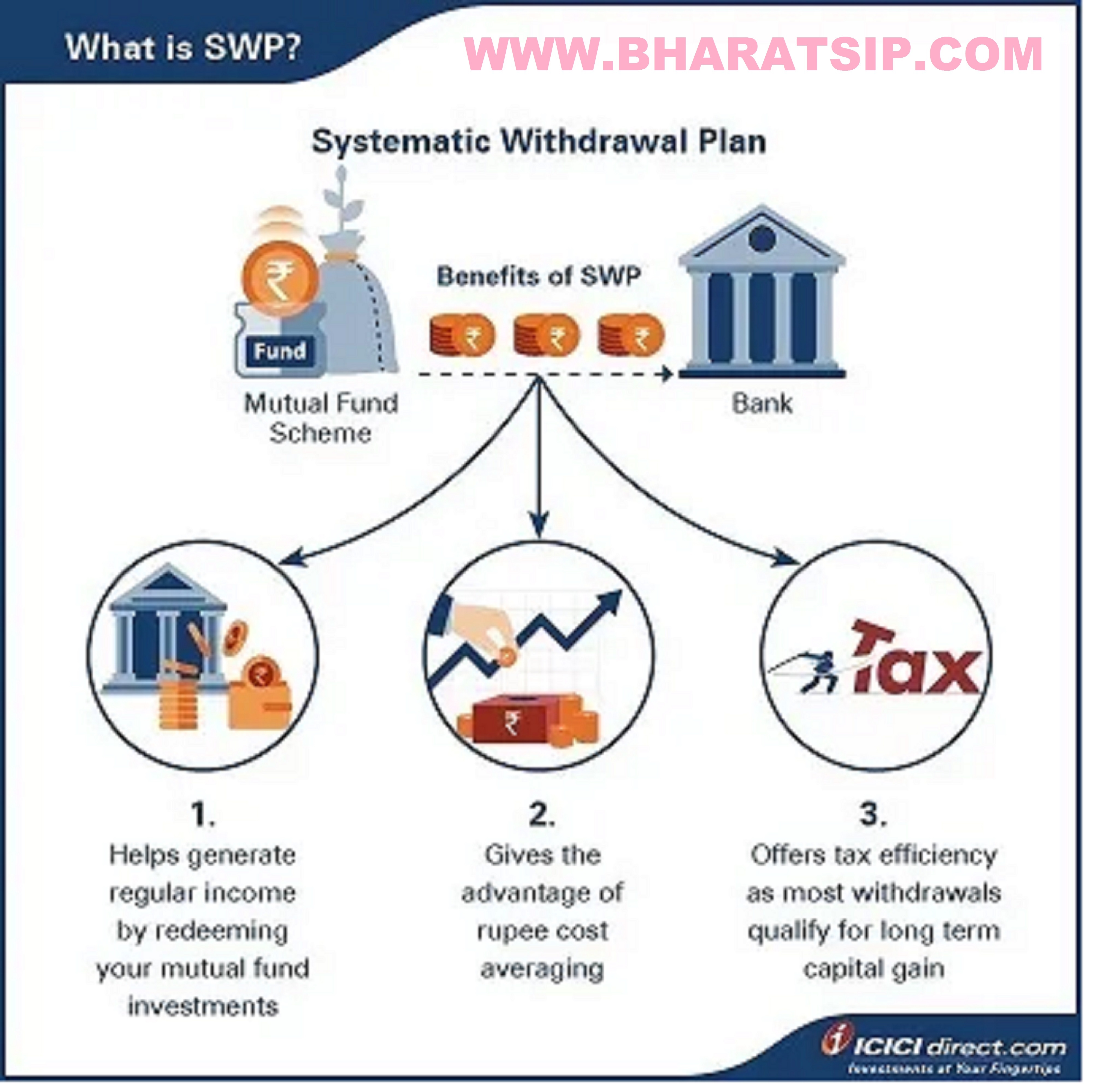

About Systematic Withdrawal Plan SWP

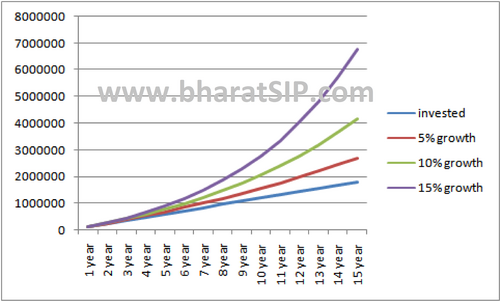

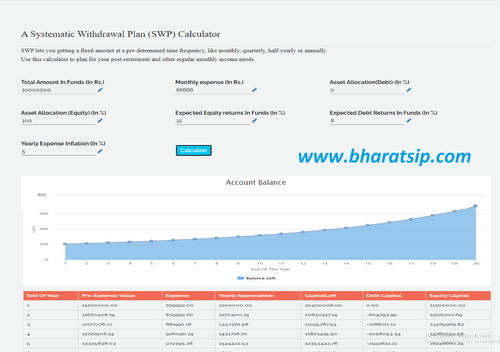

At www.bharatsip.com you can invest in Systematic Withdrawl Plan (SWP) for getting monthly payout into bank account...get more than bank Fixed Deposit Returns and also stand a change to increase your Principal Amount...How it works:

Assuming you get a return of 12% PA for the investment...

Pay out is set @8% per annum paid monthly, balance 4% gets added to the Principal amount at the end of the Year...

How SWP Works

SWP enables investors to systematically redeem a fixed or variable number of mutual fund units at set intervals: monthly, quarterly, semi-annually, or annually. This automation allows for hassle-free, scheduled cash flow, directly transferred to your registered bank account.

Eligibility and Documentation

All investors of eligible mutual fund schemes in India can opt for SWP. While most funds permit SWP without restriction, tax-saving funds have a mandatory lock-in period. Registration requires completing the SWP form with your mutual fund provider.

Flexibility & Control

The investor enjoys significant control over withdrawal frequency and amount. You can modify or cancel the SWP at any time following your AMC's rules, making it easy to adjust based on changing financial needs or market conditions.

FAQ's of Systematic Withdrawal Plan SWP:

Q: How can I set up a Systematic Withdrawal Plan (SWP) with my mutual fund?

A: To establish an SWP, complete the SWP registration form provided by your mutual fund house, specify your desired withdrawal frequency and amount, and select a start date. The process is initiated by the asset management company (AMC) as per your instructions.Q: What are the eligibility criteria for SWP in mutual funds?

A: SWP is available to all investors of eligible mutual fund schemes. However, tax-saving funds require you to complete the prescribed lock-in period before starting an SWP.Q: When will the withdrawals take place once I register for an SWP?

A: Withdrawals begin on the start date you select during registration and continue at the chosen intervals-monthly, quarterly, semi-annually, or annually-until your units are depleted or the end date you have specified is reached.Q: Where are the SWP payouts credited and can I change my bank details?

A: SWP amounts are directly transferred to your registered bank account. You may update your bank details with the AMC by submitting the required documentation before your next scheduled payout.Q: What is the process for modifying or cancelling an SWP?

A: You can request modification or cancellation of your SWP anytime by submitting a written request to your AMC, following their specific rules and procedures. Changes take effect as per the AMC's operational timelines.Q: What are the benefits and uses of choosing SWP in mutual funds?

A: SWP offers you regular cash flow, flexible withdrawal options, and the ability to customize withdrawals according to your income needs. It is ideal for generating passive income, such as during retirement or for specific financial goals.Q: Are there any charges or tax implications associated with SWP withdrawals?

A: SWP withdrawals may be subject to exit load as per the respective mutual fund scheme rules. Taxation depends on the fund type and the holding period, so consult the scheme information and your tax advisor for specific implications.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

More Products in Income Plan Service Category

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry