Loan Against Securities

Price 50000.0 INR/ Number

MOQ : 1 Number

Loan Against Securities Specification

- Maximum Loan Amount

- Up to 80-90% of value of securities (subject to lender policy)

- Minimum Loan Amount

- As specified by lender (generally starts from INR 50,000)

- Product Name

- Loan Against Securities

- Interest Rate

- Depends on lender and type of security

- Collateral Requirement

- Pledge of approved securities

- Prepayment Charges

- May or may not apply as per lender's terms

- Processing Fee

- Varies as per lender norms

- Renewal Facility

- Permissible as per lender policy upon review of security value

- Security Type

- Shares, Bonds, Mutual Funds, Insurance Policies, etc.

- Disbursal Time

- Generally within 24-48 hours after security pledge

- Eligibility Criteria

- Indian residents, corporate entities, NRIs (subject to lenders conditions)

- Loan Amount

- Based on market value of pledged securities

- Repayment Tenure

- Flexible; as per agreement

- Usage/Application

- For availing loan against financial securities

- Documentation Required

- Identity proof, address proof, security holding statement, PAN card

- Nature of Facility

- Overdraft or term loan, as opted by customer

Loan Against Securities Trade Information

- Minimum Order Quantity

- 1 Number

- FOB Port

- online

- Supply Ability

- 1000 Per Day

- Delivery Time

- 1 Days

- Sample Available

- No

- Main Domestic Market

- All India

About Loan Against Securities

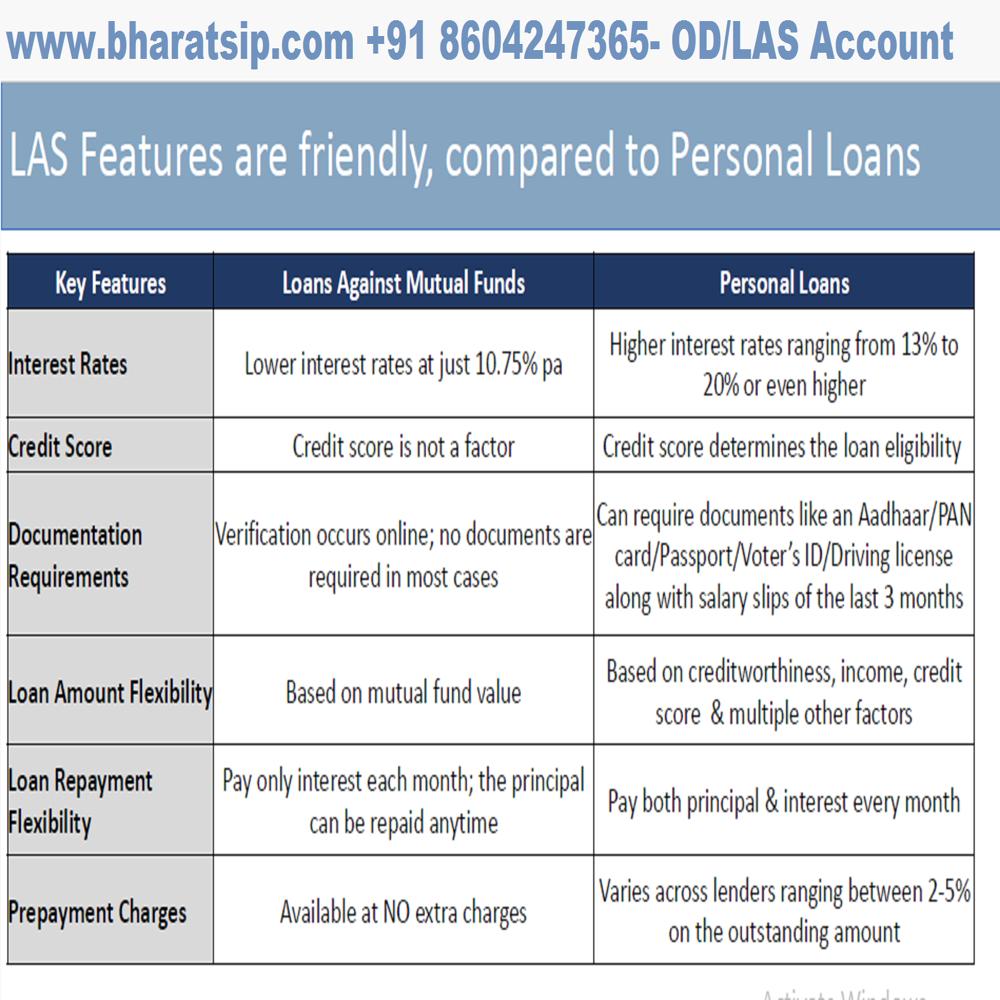

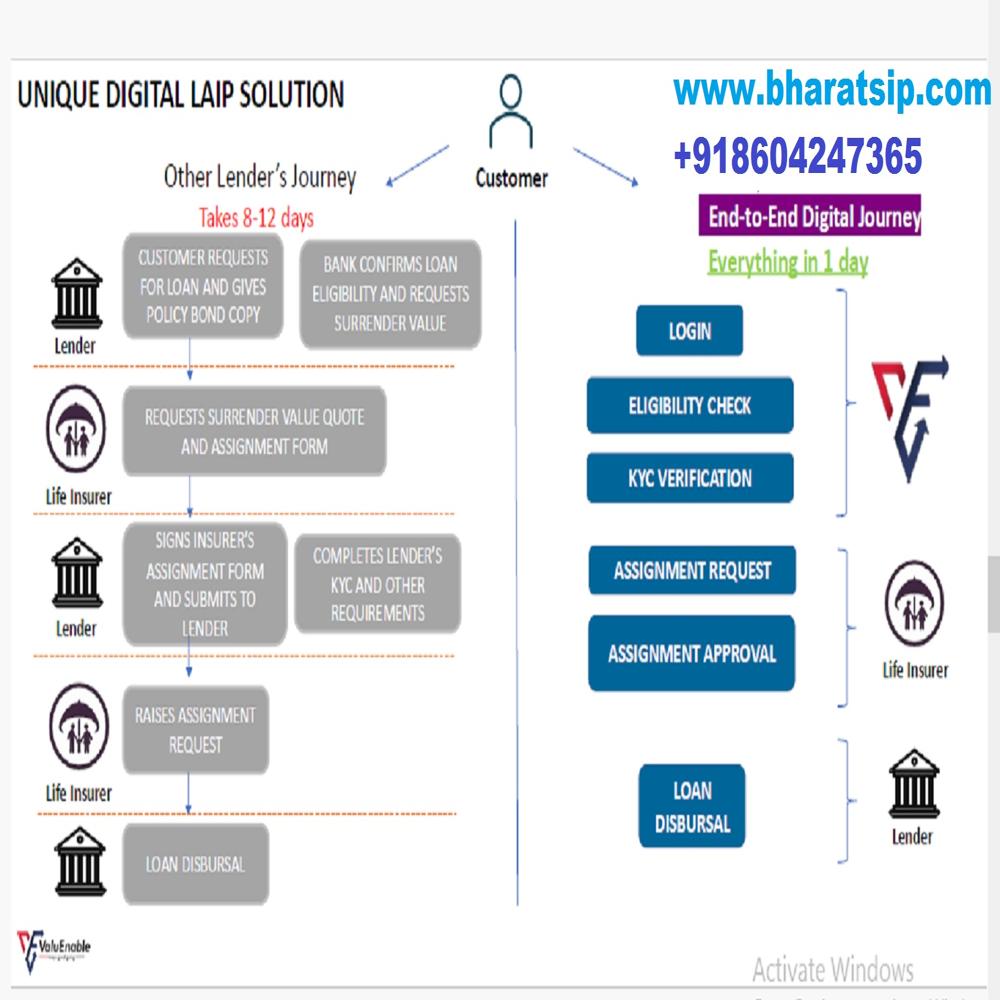

Most of the Investors in Stocks/Mutual Funds/Bonds/Insurance end up withdrawing/discontinuing the Investments due to some Financial Emergency resulting in premature closure of their investment and thereby their dream for child's education/marriage, financial security for the later days, retirement corpus, Purchase of Home/Car etc midway. The investments don't serve their purpose as they are stopped/prematurely closed/withdrawn. What if you have an emergency Overdraft Account with the same investments being pledged... Get upto 85% of your investment as loan from Us at Bharatsip...at attractive interest rates You continue with your investing and also have liquidity through OD account. Make all your dreams come true with LAS OD Account Our Loan Against Securities(LAS) is a complete digital online process, dispersed same day from the comfort of your home/office. It is completely secure tooSwift Financing via Security Pledge

Unlock the value of your financial securities without selling them. Loan Against Securities offers rapid access to funds for diverse needs. By pledging shares, bonds, mutual funds, or insurance policies, you can secure a loan amount based on market value-typically up to 80-90%-with minimal documentation and competitive rates. Choose between overdraft or term loan facilities depending on your requirements and enjoy speedy disbursal generally within 24-48 hours post-approval.

Flexible Terms and Loan Usage

Borrowers benefit from flexible repayment tenures and repayment options, making this facility suitable for individuals, corporates, and NRIs (as per lender's terms). The funds can be used for various personal, business, or investment needs, while the ownership of securities remains intact. Renewal and prepayment options are also available subject to lender policies, enhancing the facility's adaptability to your financial needs.

FAQ's of Loan Against Securities:

Q: How does a Loan Against Securities work?

A: A Loan Against Securities allows you to pledge approved financial assets such as shares, bonds, mutual funds, or insurance policies as collateral. In return, you can avail a loan amount-generally up to 80-90% of the security's market value. The ownership remains with you, but the securities are temporarily held by the lender for the loan duration.Q: What is the typical processing time for a Loan Against Securities?

A: Once your securities are pledged and all documentation is submitted, lenders usually disburse the loan within 24-48 hours, making this a quick fundraising solution.Q: Who is eligible to apply for a Loan Against Securities?

A: Indian residents, NRIs (as per lender's policies), and corporate entities can apply. Eligibility also depends on the type and value of the securities offered and the lender's specific criteria.Q: What documents are required to apply for this loan?

A: Generally, you need to provide identity proof, address proof, a security holding or demat statement, and your PAN card. Lenders may request additional documents as per their policy.Q: What types of securities can be pledged for this loan facility?

A: You can pledge a wide range of financial instruments such as listed shares, bonds, mutual fund units, and insurance policies, depending on what the lender accepts.Q: Is there flexibility in repayment and prepayment options?

A: Yes, lenders offer flexible repayment options and tenures. Prepayment charges may or may not apply based on the lender's terms, allowing borrowers to manage repayments as per their convenience.Q: What are the benefits of taking a Loan Against Securities?

A: This facility provides quick liquidity without needing to liquidate your investments. It offers high loan amounts based on market value, retains investment ownership, and provides flexible repayment terms, making it a versatile solution for immediate financial needs.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry